Rates

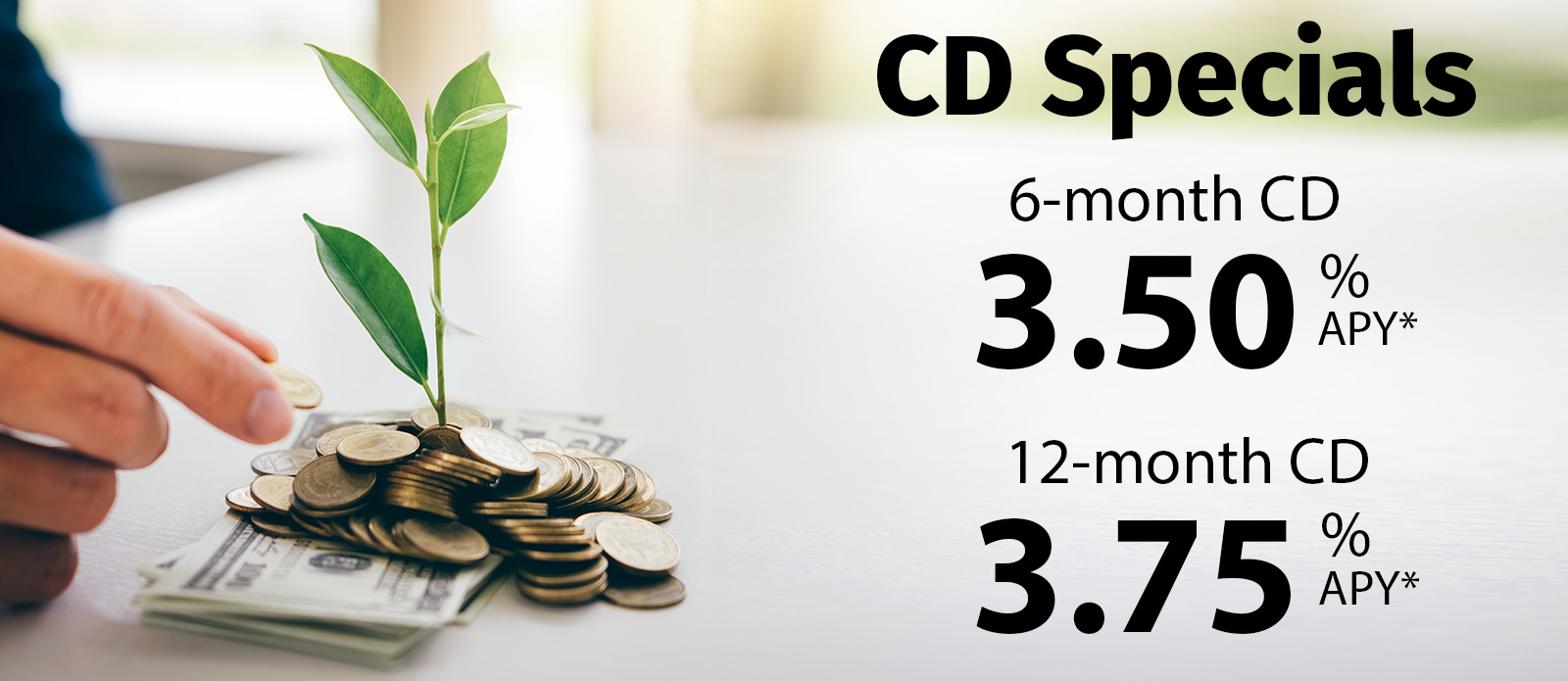

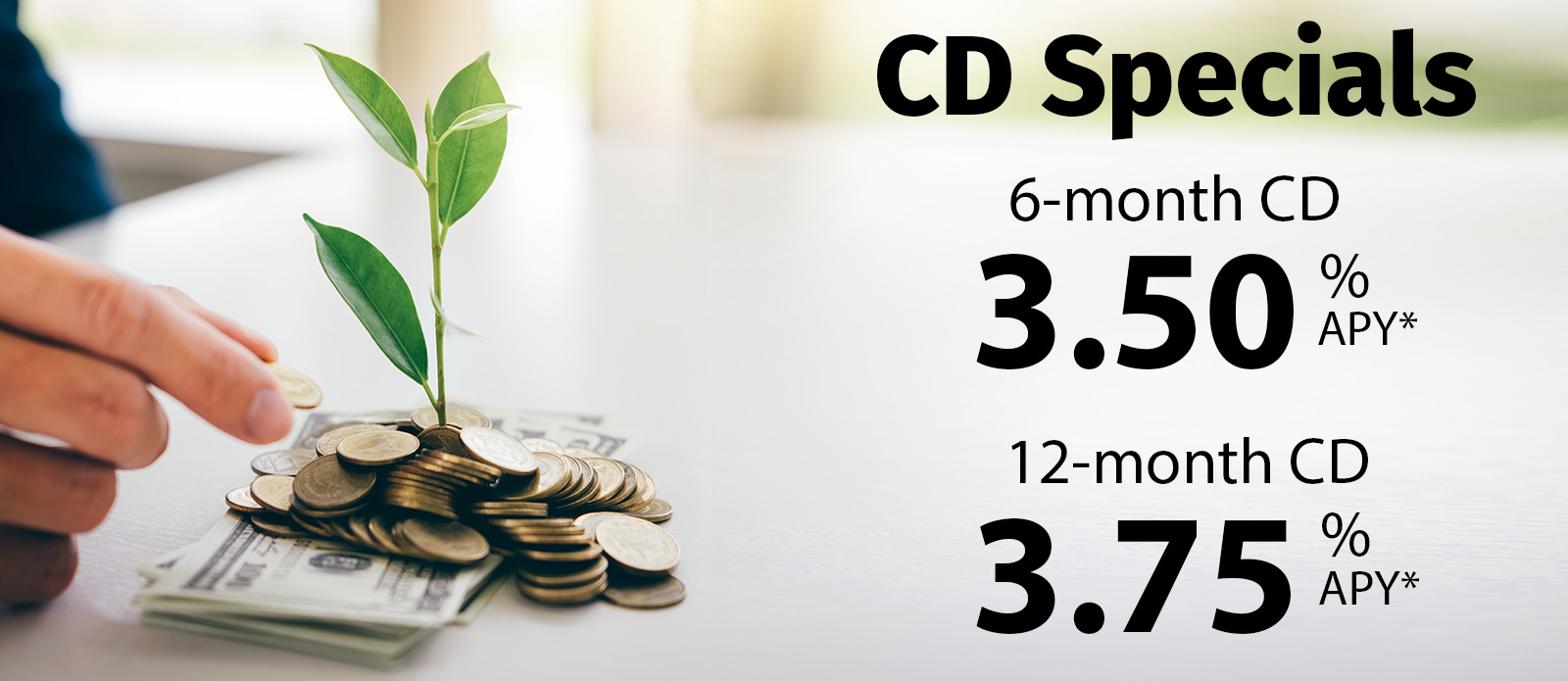

*APY = Annual Percentage Yield. Rates effective 2/3/26 and are subject to change without notice. Minimum opening deposit is $5,000. A penalty may be imposed for early withdrawal. ECU membership required. Federally insured by NCUA.

*APR = Annual Percentage Rate. Rates are based on credit rating and are subject to normal credit approval. Rates effective 11/7/25 and are subject to change without notice. As low as rates are based on a credit score of 740+, a loan-to-value less than 80% and include discounts for at least two of the following services: ECU direct deposit, GAP insurance, Mechanical breakdown insurance, credit life/disability insurance or an insurance policy through Educators Insurance Services. Rate stated is for a 25-month term, 2019 model or newer. PAYMENT EXAMPLE: $41.75 per $1,000 financed at 3.99% for 25 months. Other rates and terms available. Excludes existing ECU loans and Indirect loans. Certain restrictions apply. ECU membership required. Federally Insured by NCUA.

rates_auto table| New Automobile | 4.99% | 66 |

| New Automobile (exceeding $18,000) | 5.24% | 67-75 |

| New Automobile (over $25,000) | 6.69% | 84 |

| Used Automobile 2020-2026 | 4.99% | 66 |

| Used Automobile 2020-2026 (less than 75K miles) | 5.24% | 67-75 |

| Used Automobile 2020-2026 (over $25,000, less than 40K miles, non-current year) | 6.69% | 84 |

| Used Automobile 2016 to 2019 | 7.19% | 48 |

rates_rv table| New or Used 2019-2025 | 7.20% | 63 |

| New or Used 2019-2025 (exceeding $18,000) Boat or RV Only | 8.20% | 64-75 |

| Used 2018 and older | 9.95% | 48 |

rates_personal table| Signature | 11.94% | 63 |

rates_home_equity table| Home Equity Loan | Call for quote | 60 |

| Home Equity Loan | Call for quote | 120 |

| Home Equity Loan | Call for quote | 180 |

| Home Equity Loan | Call for quote | 240 |

rates_cards table| Platinum MasterCard(reg) | 9.75% | 1 |

*APR = Annual Percentage Rate

Annual Percentage Rate is as low as. Rate is based on credit rating and is subject to normal credit approval. Rates and terms are subject to change without notice. Other restrictions may apply. Contact the credit union for details.

Savings Account Rates

rates_savings table| Regular Savings | 0.40% | 0.40% | 365 |

| IRA Savings | 0.40% | 0.40% | 365 |

rates_checking table| Share Draft Checking | 0.10% | 0.10% | 365 |

| College Choice Checking | 0.10% | 0.10% | 365 |

| Direct Choice Checking | 0.10% | 0.10% | 365 |

| Club 55+ | 0.10% | 0.10% | 365 |

rates_money_market table| With balance of $2,500 and up | 1.10% | 1.11% | 365 |

| | | |

| | | |

| | | |

*APY=Annual Percentage Yield

**Annual Percentage Yield (APY) is based on the average daily balance. Minimum balance required to earn the disclosed Annual Percentage Yield. Fees may reduce earnings. A penalty may be imposed for early withdrawal.

Certificate of Deposit Rates

rates_certificates table| Regular Certificate of Deposit (CD) | 2.00% | 2.02% | 6** |

| Regular Certificate of Deposit (CD) | 2.25% | 2.27% | 12 |

| Regular Certificate of Deposit (CD) | 2.50% | 2.53% | 24 |

| Regular Certificate of Deposit (CD) | 2.50% | 2.53% | 36 |

| Regular Certificate of Deposit (CD) | 2.50% | 2.53% | 48 |

| Regular Certificate of Deposit (CD) | 2.50% | 2.53% | 60 |

*APY=Annual Percentage Yield. Minimum opening deposit $1,000. Fees may reduce earnings. A penalty may be imposed for early withdrawal.

**Minimum opening deposit for 6 month CD $5,000.